Novated lease calculator

Work out your estimate and quote.

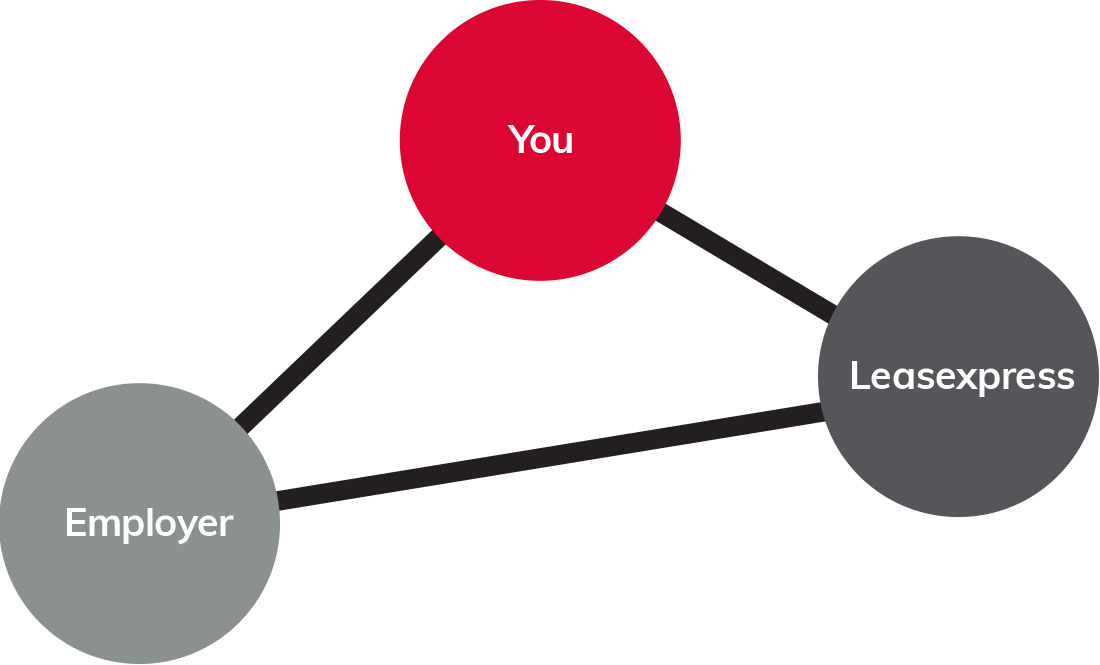

A Leasexpress Novated lease is one of the most cost-effective ways to finance a car. It involves a three-way agreement between you, your employer and Leasexpress.

A Novated lease allows you to pay a portion of your vehicle's costs pre-tax reducing your taxable income and therefore the amount of tax you pay.

Your car lease includes the finance and running costs like fuel, insurance and scheduled servicing and are included in a single payment which is deducted from your salary each pay cycle.

You can access significant income tax savings by paying for your car and its running costs from your pre‑tax income through your employer. When you buy your car from a registered dealer, as opposed to a private seller, you’ll also save the GST on the purchase price, as well as the GST on your running costs.

At Leasexpress we get you the best pricing on your new car purchase, and the best value for your trade‑in. You can also choose to novate a used car or the car you currently own, as well as novate a second car if you choose to increase your savings!

Let us take care of your servicing and repairs by monitoring and billing suppliers directly for all work done on your car. Our expert team help you avoid over‑servicing and over‑charging, and get you access to fleet discounts on parts and labour.

Enjoy the ease of 24/7 access to your online account to keep track of your vehicle expenses including transaction and history reports.

Leasexpress top Novated Lease Questions. Please contact our dedicated team should your question not be answered here.

How does a Novated lease work?

Under a Novated lease, you agree to forgo a portion of your salary to cover your car’s running costs, all of which you can pay for in pre‑tax dollars. At Leasexpress we then use your regular salary deductions to pay for your cars running costs on your behalf.

What does a Novated lease include?

A Novated lease includes all of your car’s major running costs, including:

What is a Residual value?

The residual value is the amount that remains owing on your car at the end of the lease contract. Minimum residual values are set by the ATO (Australian Tax Office). At the end of your fixed lease term, you have the option to re‑finance the lease for a further term. Alternatively, if you choose to purchase the motor vehicle for the residual value, GST will be payable on this purchase transaction.

How is your Employer involved?

Under a novation agreement, your employer deducts a set amount from your salary (all pre-tax for electric vehicles) and remits the money to Leasexpress to pay for your car’s finance payments and running costs as they fall due.

What kind of Car can you choose?

You are able to choose any car, any make, any model Australia wide. You can also choose from:

What Car products are not included in a Novated lease?

Under Australian Tax Office (ATO) guidelines, the following items cannot be included under your Novated lease:

What other factors should I consider before choosing a Novated lease?

You are encouraged to seek independent financial advice to determine whether a Novated lease is right for your financial situation.

Novate new, used or existing vehicles.